Determine the Amount of Tax Liability in the Following Situations

In all cases the taxpayer is using the filing status of married filing jointly. Round your intermediate computations to 2 decimal places and final answer to the.

Tax Liability What Is A Tax Liability And What You Should Know

Taxable income of 12932 that includes a qualified dividend of 322.

. In all cases the taxpayer is using the filing status of married filing jointly. Taxable income of 62449 that includes a qualified dividend of 560. Taxable income of 64537 that includes qualified dividend income of.

Use the appropriate Tax Tables or Tax Rate Schedules. Do not round intermediate calculations. In all cases the taxpayer is using the filing status of married filing jointly.

In all cases the taxpayer is using the filing status of married filing jointly. Use the Tax Tables for taxpayers with taxable income under 100000 and the Tax Rate Schedules for those with taxable income above 100000. Determine the amount of tax liability in the following situations.

In 2019 her taxable income is 40000. In all cases the taxpayer is using the filing status of married filing jointly. Taxable income of 62449 that includes a qualified dividend of 560.

In all cases the taxpayer is using the filing status of married filing jointly. What is her tax liability in each of the following alternative situations. Use the Tax Tables for taxpayers with taxable income under 100000 and the Tax Rate Schedules for those with taxable income above 100000.

1 Answer to Determine the amount of tax liability in the following situations. Use the Tax Tables income under 100000 and the Tax Rate Schedules for those with taxable income above 100000. Determine the amount of tax liability in the following situations.

Round your intermediate computations to 2 decimal places. In all cases the taxpayer is using the filing status of married filing jointly. In all cases the taxpayer is using the filing status of married filing jointly.

Use the appropriate Tax Tables or Tax Rate Schedules. In all cases the taxpayer is using the filing status of married filing jointly. Determine the amount of tax liability in the following situations.

Determine the amount of tax liability in the following situations. In all cases the taxpayer is using the filing status of married filing jointly. Lacy is a single taxpayer.

In all cases the taxpayer is using the filing status of married filing jointly. Determine the amount of tax liability in the following situations. In all cases the taxpayer is using the filing status of married filing jointly.

Taxable income of 22279 that includes a qualified dividend of 363. Taxable income of 12932 that includes a qualified dividend of 322. Use Tax Rate Schedule Dividends and Capital Gains Tax Rates for reference.

Taxable income of 62449 that includes a qualified dividend of 560. Determine the amount of tax liability in the following situations. Use the appropriate Tax Tables or Tax Rate Schedules.

Determine the amount of tax liability in the following situations. In all cases the taxpayer is using the filing status of married filing jointly. Determine the amount of tax liability in the following situations.

Determine the amount of tax liability in the following situations. In all cases the taxpayer is using the filing status of married filing jointly. Problem 3-38 LO 3-3 Determine the amount of tax liability in the following situations.

Use the appropriate Tax Tables or Tax Rate Schedules. Determine the amount of tax liability in the following situations. Taxable income of 12932 that includes a qualified dividend of 322.

In all cases the taxpayer is using the filing status of married filing jointly Use the appropriate Tax Tables or Tax Rate Schedules. Taxable income of 62449 that inciudes a qualified dividend of 560. Taxable income of 63493 that includes a qualified dividend of 960.

Determine the amount of tax liability in the following situations. Taxable income of 12932 that includes a qualified dividend of 322. Taxable income of 62449 that includes a.

Use the appropriate Tax Tabies or Tax Rate Schedules a. Taxable income of 12932 that includes a qualified dividend of 322. Taxable income of 63069 that includes a qualified dividend of 660.

Taxable income of 62449 that includes dividend income of 560. Determine the amount of tax liability in the following situations. Round your answer to 2 decimal places.

Determine the amount of tax liability in the following situations. 38 Determine the amount of tax liability in the following situations. Taxable income of 12932 that includes a qualified dividend of 322.

In all cases the taxpayer is using the filing status of married filing jointly. Tax Accounting Chapter 8. Taxable income of 12932 that includes dividend income of 322.

Use the Tax Tables income under 100000 and the Tax Rate Schedules for those with taxable income above 100000. Determine the amount of tax liability in the following situations. Use the appropriate Tax Tables or Tax Rate Schedules.

Use the tax tables for taxpayers with taxable income under 100000 and the tax rate schedules for those with taxable income above 100000. Determine the amount of tax liability in the following situations. Taxable income of 144290 that includes dividend income of 4384.

Taxable income of 62449 that includes a qualified dividend of 560. In all cases the taxpayer is using the filing status of married filing jointlya. In all cases the taxpayer is using the filing status of married filing jointly.

Determine the amount of tax liability in the following situations. Use the Tax Tables for taxpayers with taxable income under 100000 and the Tax Rate Schedules for those with taxable income above 100000. Taxable income of 62449 that includes a qualified dividend of 560.

Use the appropriate Tax Tables or Tax Rate Schedules. Taxable income of 13212 that includes a qualified dividend of 361. Use the Tax Tables for taxpayers with taxable income under 100000 and the Tax Rate Schedules for.

Taxable income of 12932 that includes a qualified dividend of 322. Use the appropriate Tax Tables or Tax Rate Schedules. In all cases the taxpayer is using the filing status of married filing jointly.

In all cases the taxpayer is using the filing status of married filing jointly. Taxable income of 62449 that includes a qualified dividend of 560. Determine the amount of tax liability in the following situations.

Up to 256 cash back Determine the amount of tax liability in the following situations. Use the Tax Tables for taxpayers with taxable income under 100000 and the Tax Rate Schedules for those with taxable income above 100000. Iin all cases the taxpayer is using the filing status of married filing jointly.

Tax On Winnings Of Game Shows And Lottery Abc Of Money

What Is Tax Liability Explained Abc Of Money

Guide To Taxable Income For Individuals How To Calculate Your Taxable Income Amount Estimated Tax Payments Income Federal Income Tax

Tax Liability What Is A Tax Liability And What You Should Know

Exploring The Estate Tax Part 2 Journal Of Accountancy

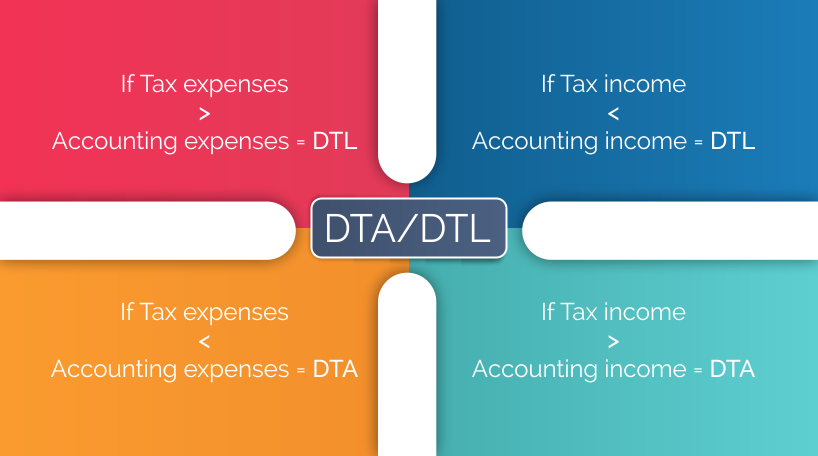

What Is Deferred Tax Asset And Deferred Tax Liability Dta Dtl Taxadda

Understanding Your Tax Liability Smartasset

What Is Tax Liability Explained Abc Of Money

Understanding Your Tax Liability Smartasset

Excel Template Tax Liability Estimator Mba Excel

Solved Tax Liability Based On Residental Status Of Assessee Sag Infotech

What Is My Filing Status It Determines Your Tax Liability

What Are Deferred Tax Assets And Deferred Tax Liabilities Article

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

Comments

Post a Comment